Visa/Mastercard processing for any niche from 2%

Our pre-warmed Stripe accounts with high block resistance allow you to focus on your business, not on solving payment problems.

Our advantages

Uninterrupted operation with 99.9% uptime

In the event of a failure, payments are automatically redirected to another warmed-up Stripe account via our "Payment routing" technical solution.

Fully configured Stripe accounts

Our accounts have passed all necessary verifications (director's identity, business, nature of activity) and are capable of withstanding turnover of up to $500,000/month.

Flexibility to work with any topics

We work with all permitted and prohibited niches, provided we offer an ultra-low Chargeback Rate.

Optimization of the tax burden

Our Stripe accounts are registered in tax-free jurisdictions, which allows us to reduce tax costs.

Access to CRM for transaction control

Each client receives access to a CRM system where they can track payments, their status, and download reports to Excel/CSV.

Withdrawal of funds without restrictions

Withdraw in EUR, USD, PLN, and other currencies to any IBAN, as well as USDT (with an additional conversion fee). Unlimited payouts on the third day.

Our services

Integrated solutions:

Company + Bank account + Stripe

A complete turnkey business registration package across jurisdictions.

Payment processing

2% + of turnover

- Connecting to the client’s website via API.

- Using “Payment cloaking” technology to hide the source of transactions.

- Invoice/Payment Link issuance without the need for technical integration.

Sale of ready-made accounts

fintech platforms

- Revolut Personal / Business

- Wise Personal / Business

- Airwallex

- Other European fintech accounts.

Support and advice

We offer a free expert consultation to every client.

You can contact us via Telegram chat.

How do we work?

Free consultation with an expert

We help you understand business issues and proposals.

Individual offer

We create a solution that meets your goals.

Checking the client's business

We analyze the stability and risks of your business.

Integration and launch of processing

We will set up and launch processing, ensuring its uninterrupted operation.

Our clients

Marketplaces

For platforms offering goods and services from various suppliers.

SaaS services

For companies providing software as a service.

Online and offline businesses

For different types of businesses operating online and in real life.

Subscription services

For models with periodic payment for services.

E-commerce

For online stores and trading platforms.

Courses and trainings

For educational platforms and trainings.

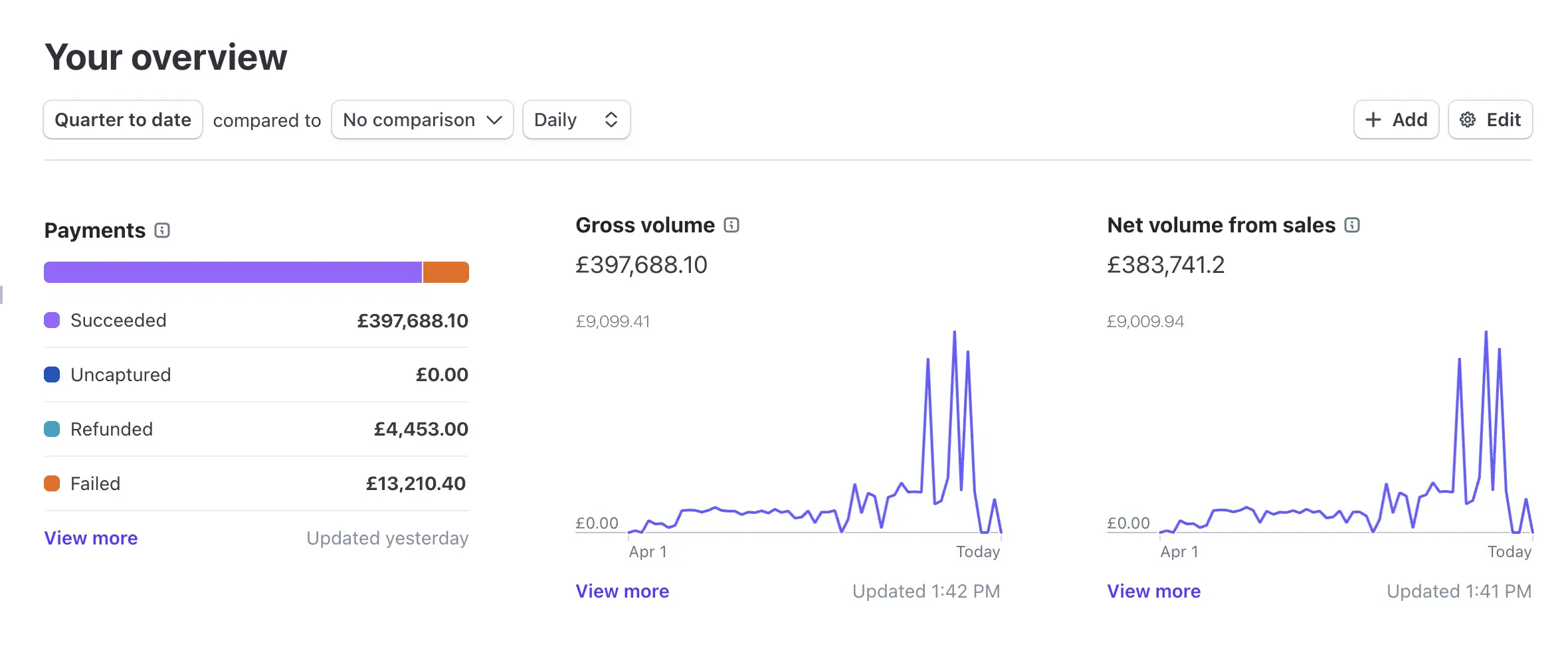

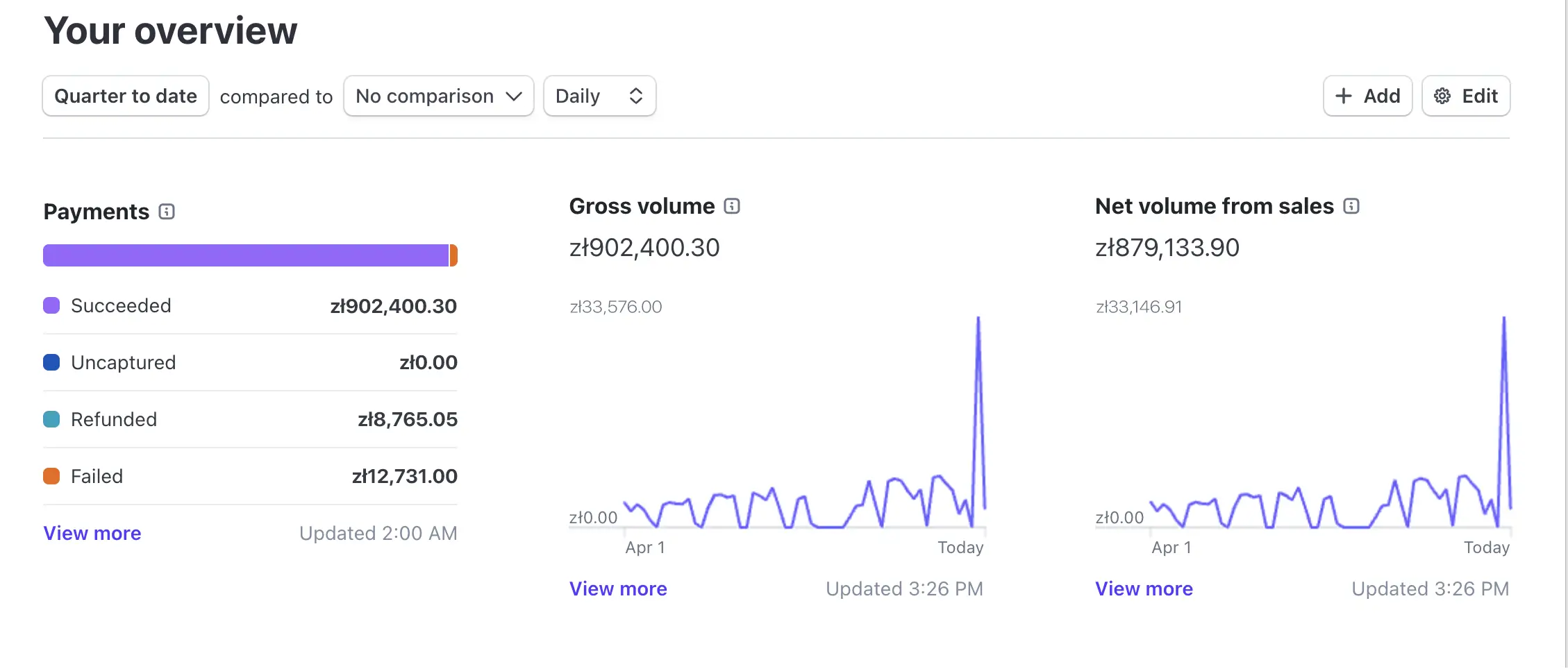

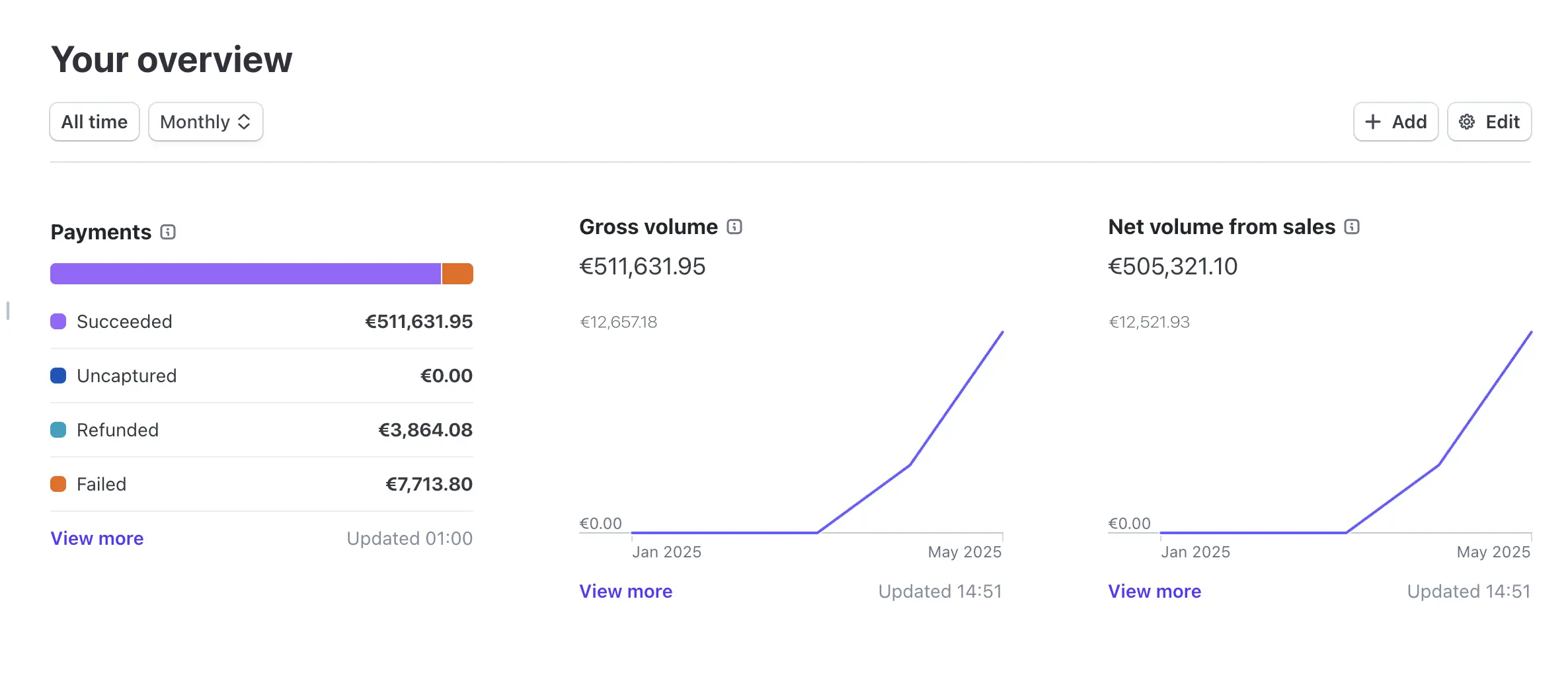

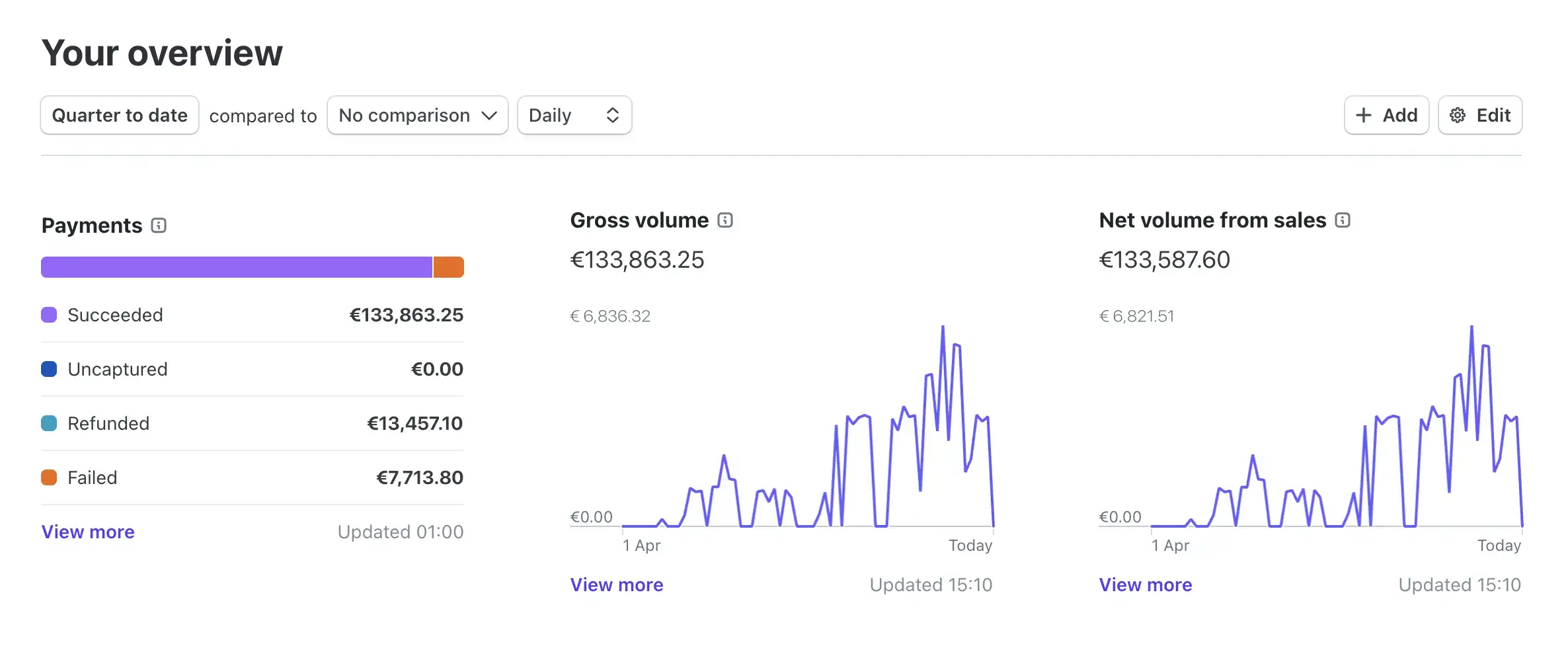

Our results in numbers

years in the field of payment processing

million total turnover of customer payments

companies and Stripe accounts opened on a turnkey basis

our clients confidently recommend us

Accounts in progress

Warmed-up Stripe accounts with turnover are always available

In the event of a failure, payments are automatically redirected to another warmed-up Stripe account via our "Payment routing" technical solution.

Accept payments in a way that suits your customers:

How do we minimize the Chargeback Rate?

Smart payment routing

The system automatically distributes payments between multiple Stripe accounts.

Additional customer verification

Our system automatically filters out suspicious transactions before payments.

Preliminary analysis of returns

The system automatically distributes payments between multiple Stripe accounts.

Solutions for your questions

1.How do we minimize the Chargeback Rate?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

2.Which international payment systems are available for connection?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

3.How to open a bank account in a foreign bank?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

4.How to get a foreign bank card?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

5.What are the benefits of working with Card Processing for business?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

6.How do I connect Stripe or PayPal to accept international payments?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

7.What documents are required to register a company abroad?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.

8.How can I get advice on entering the international market?

Stripe: A popular online payment platform that supports over 135 currencies and is available in 47 countries.

PayPal: a well-known electronic payment system that allows you to make transfers and receive payments all over the world.

2Checkout: a payment system that provides solutions for accepting international payments and supports various payment methods.

Square: a payment processing platform offering business tools, including mobile card acceptance solutions.

Authorize.Net: an international acquiring system suitable for entrepreneurs working with the USA, Canada, Europe and Australia.

Braintree: a payment system owned by PayPal that supports over 130 currencies and is available in various countries.